Will U.S restrictions hamper China’s plans? And then the more traditional innovation-related infrastructure gets a nod, things like better equipment for universities and research institutes. The integrated/fused infrastructure piece includes smart transportation, infrastructure, and smart energy facilities - think more charging stations for EVs tied to China’s grid, which is getting very smart under the State Grid Corporation, one of the leading appliers for AI-related patents. New infrastructure also includes blockchain! Blockchain has been an area where senior Chinese officials have latched on to the technology as one with low barriers to entry and one where Chinese companies can play a major role - hence, the Blockchain Services Network concept that was rolled out earlier this year. It includes new data centers, industrial internet capacity, IoT, artificial intelligence (AI), and even satellite-delivered internet services that will extend the delivery of broadband services to more remote areas. This word salad means the concept of new infrastructure is more expansive than simply building out 5G. In addition, the National Development and Reform Commission (NDRC) suggests that new infrastructure will include three main areas: new information infrastructure (信息基础设施 xìnxī jīchǔ shèshī), integrated/fused infrastructure (融合基础设施 rónghé jīchǔ shèshī), and innovation-related infrastructure (创新基础设施 chuàngxīn jīchǔ shèshī).

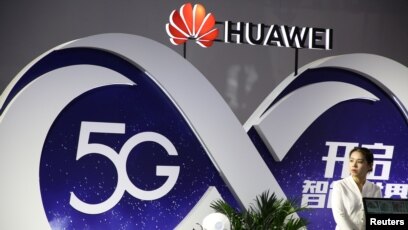

5G TECHNOLOGY IN CHINA UPGRADE

This also comes under the existing concept of the industrial internet and the Industrial Internet of Things (IIoT), all part of a longer-term strategy to upgrade China’s industrial base for the digital age. Data centers that facilitate mobile edge computing (MEC) - basically pushing some of the cloud-based capabilities that will be required to drive smart factors and cities out to the edge of networks - are also a big part of the new infrastructure push.

5G TECHNOLOGY IN CHINA FULL

The plan from Beijing is to accelerate the deployment of full stand-alone 5G networks, meaning the low latency and IoT portions, particularly at the local level in Chinese provinces that are not well developed and are eager for digital transformation that will be enabled by 5G. But here there are still many unknowns about who will pay for new services, and how infrastructure companies and innovators will develop business cases that make sense and return sufficient value.Įnter new infrastructure. The former will enable autonomous vehicles and smart factories, the second will power applications that require large sensor deployments to be networked together - think smart cities or smart agriculture. This is a messy process and it takes time: Globally, it took about five to seven years after the 2010 launch of 4G LTE networks before they were widely available enough to enable killer apps like Uber and Lyft, and for the mobile versions of popular applications and payments systems to become convenient enough to become indispensable for day-to-day use by consumers.įor 5G, the real promise - in addition to faster HD movies streaming to your new handset, and those of tens of thousands of others, say, at a soccer game - is the addition of two major components to 5G: ultra reliable low latency communications (i.e., optimized to process high volumes of data with minimal delays), and massive machine-to-machine communications. But as always with changeovers in wireless generations, there is a chicken-and-egg issue: There is a need for sufficient infrastructure to enable those applications, for companies that can do the innovation, and for market demand so that such companies are incentivized to build both the infrastructure and the applications. The real promise of 5G and next-generation handsets, smart devices, and Internet of Things (IoT) sensors being widely deployed is actually not the infrastructure, but the applications that run over them. Beijing has long had a 5G next-generation strategy in place, so what is new about the infrastructure being pushed now from Beijing? By the end of the year, so-called stand-alone 5G networks will be rolled out in some areas.

What’s new about “new infrastructure”?Ĭhina already has massive numbers of 5G base stations operating in all first-tier cities, and will soon have more in second-tier and third-tier cities. The powerful National Development and Reform Commission (NDRC) also laid out the framework for the government’s thinking on new infrastructure before the NPC in May. The term was also mentioned at a Politburo Standing Committee meeting in March.

Key Chinese industrial ministries had already been talking up new infrastructure over the past year and a half, since a central Economic Work Conference meeting in late 2018.

0 kommentar(er)

0 kommentar(er)